A trading strategy backtesting library in Node.js based on Danfo.js and inspired by backtesting.py.

$ npm install --save @fugle/backtest// Using Node.js `require()`

const { Backtest, Strategy } = require('@fugle/backtest');

// Using ES6 imports

import { Backtest, Strategy } from '@fugle/backtest';The following example use technicalindicators to calculate the indicators and signals, but you can replace it with any library.

import { Backtest, Strategy } from '@fugle/backtest';

import { SMA, CrossUp, CrossDown } from 'technicalindicators';

class SmaCross extends Strategy {

params = { n1: 20, n2: 60 };

init() {

const lineA = SMA.calculate({

period: this.params.n1,

values: this.data['close'].values,

});

this.addIndicator('lineA', lineA);

const lineB = SMA.calculate({

period: this.params.n2,

values: this.data['close'].values,

});

this.addIndicator('lineB', lineB);

const crossUp = CrossUp.calculate({

lineA: this.getIndicator('lineA'),

lineB: this.getIndicator('lineB'),

});

this.addSignal('crossUp', crossUp);

const crossDown = CrossDown.calculate({

lineA: this.getIndicator('lineA'),

lineB: this.getIndicator('lineB'),

});

this.addSignal('crossDown', crossDown);

}

next(ctx) {

const { index, signals } = ctx;

if (index < this.params.n1 || index < this.params.n2) return;

if (signals.get('crossUp')) this.buy({ size: 1000 });

if (signals.get('crossDown')) this.sell({ size: 1000 });

}

}

const data = require('./data.json'); // historical OHLCV data

const backtest = new Backtest(data, SmaCross, {

cash: 1000000,

tradeOnClose: true,

});

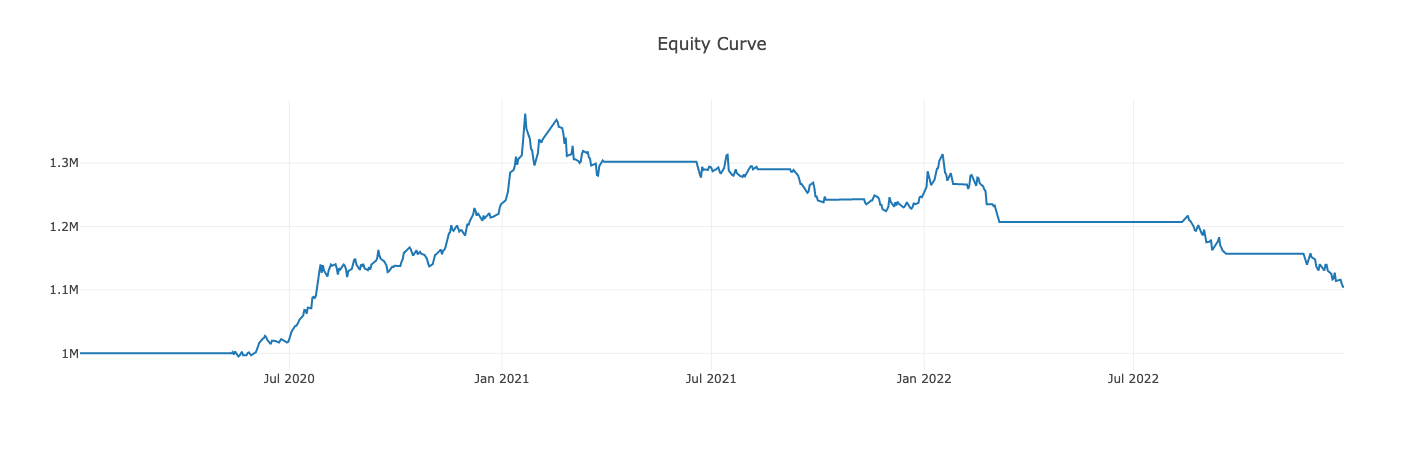

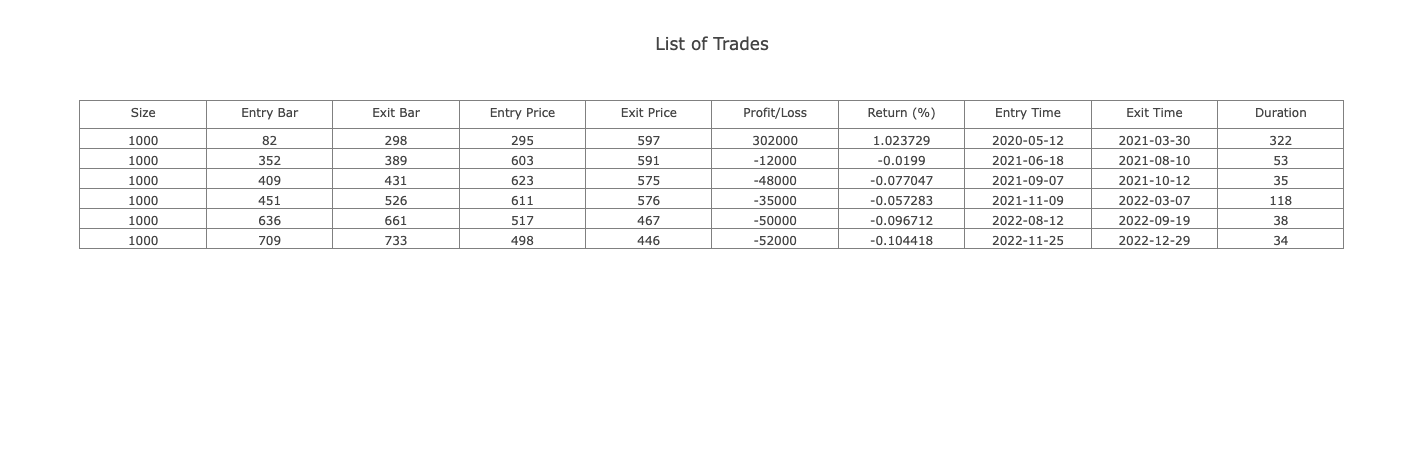

backtest.run() // run the backtest

.then(results => {

results.print(); // print the results

results.plot(); // plot the equity curve

});Results in:

╔════════════════════════╤═══════════════════════╗

║ Strategy │ SmaCross(n1=20,n2=60) ║

╟────────────────────────┼───────────────────────╢

║ Start │ 2020-01-02 ║

╟────────────────────────┼───────────────────────╢

║ End │ 2022-12-30 ║

╟────────────────────────┼───────────────────────╢

║ Duration │ 1093 ║

╟────────────────────────┼───────────────────────╢

║ Exposure Time [%] │ 55.102041 ║

╟────────────────────────┼───────────────────────╢

║ Equity Final [$] │ 1105000 ║

╟────────────────────────┼───────────────────────╢

║ Equity Peak [$] │ 1378000 ║

╟────────────────────────┼───────────────────────╢

║ Return [%] │ 10.5 ║

╟────────────────────────┼───────────────────────╢

║ Buy & Hold Return [%] │ 32.300885 ║

╟────────────────────────┼───────────────────────╢

║ Return (Ann.) [%] │ 3.482537 ║

╟────────────────────────┼───────────────────────╢

║ Volatility (Ann.) [%] │ 8.204114 ║

╟────────────────────────┼───────────────────────╢

║ Sharpe Ratio │ 0.424487 ║

╟────────────────────────┼───────────────────────╢

║ Sortino Ratio │ 0.660431 ║

╟────────────────────────┼───────────────────────╢

║ Calmar Ratio │ 0.175785 ║

╟────────────────────────┼───────────────────────╢

║ Max. Drawdown [%] │ -19.811321 ║

╟────────────────────────┼───────────────────────╢

║ Avg. Drawdown [%] │ -2.241326 ║

╟────────────────────────┼───────────────────────╢

║ Max. Drawdown Duration │ 708 ║

╟────────────────────────┼───────────────────────╢

║ Avg. Drawdown Duration │ 54 ║

╟────────────────────────┼───────────────────────╢

║ # Trades │ 6 ║

╟────────────────────────┼───────────────────────╢

║ Win Rate [%] │ 16.666667 ║

╟────────────────────────┼───────────────────────╢

║ Best Trade [%] │ 102.3729 ║

╟────────────────────────┼───────────────────────╢

║ Worst Trade [%] │ -10.4418 ║

╟────────────────────────┼───────────────────────╢

║ Avg. Trade [%] │ 5.718878 ║

╟────────────────────────┼───────────────────────╢

║ Max. Trade Duration │ 322 ║

╟────────────────────────┼───────────────────────╢

║ Avg. Trade Duration │ 100 ║

╟────────────────────────┼───────────────────────╢

║ Profit Factor │ 2.880822 ║

╟────────────────────────┼───────────────────────╢

║ Expectancy [%] │ 11.139483 ║

╟────────────────────────┼───────────────────────╢

║ SQN │ 0.305807 ║

╚════════════════════════╧═══════════════════════╝

To perform backtesting, you need to prepare historical data, implement a trading strategy, and then run a backtest on that strategy to obtain the results.

First, prepare the historical OHLCV (Open, High, Low, Close, Volume) data of any financial instrument (such as stocks, futures, forex, cryptocurrencies, etc.). The input historical data will be converted to Danfo.js DataFrame, and the data format can be either Array<Candle> or CandleList type as follows:

interface Candle {

date: string;

open: number;

high: number;

low: number;

close: number;

volume?: number;

}

interface CandleList {

date: string[];

open: number[];

high: number[];

low: number[];

close: number[];

volume?: number[];

}

type HistoricalData = Array<Candle> | CandleList;You can implement your own trading strategy by inheriting the Strategy class and overriding its two abstract methods:

-

Strategy.init(data): This method is called before running the strategy. You can pre-calculate all indicators and signals that the strategy depends on. -

Strategy.next(context): This method will be iteratively called when running the strategy with theBacktestinstance, and thecontextparameter represents the current candle and technical indicators and signals. You can decide whether to make buy or sell actions based on the current price, indicators, and signals.

Here's an example of implementing a simple average crossover strategy. The parameter n1 represents the period of the short-term moving average, and n2 represents the period of the long-term moving average. When the short-term moving average crosses above the long-term moving average, it buys 1000 trading unit. Conversely, when the short-term moving average crosses below the long-term moving average, the strategy sells 1000 trading unit.

import { Backtest, Strategy } from '@fugle/backtest';

import { SMA, CrossUp, CrossDown } from 'technicalindicators';

class SmaCross extends Strategy {

params = { n1: 20, n2: 60 };

init() {

const lineA = SMA.calculate({

period: this.params.n1,

values: this.data['close'].values,

});

this.addIndicator('lineA', lineA);

const lineB = SMA.calculate({

period: this.params.n2,

values: this.data['close'].values,

});

this.addIndicator('lineB', lineB);

const crossUp = CrossUp.calculate({

lineA: this.getIndicator('lineA'),

lineB: this.getIndicator('lineB'),

});

this.addSignal('crossUp', crossUp);

const crossDown = CrossDown.calculate({

lineA: this.getIndicator('lineA'),

lineB: this.getIndicator('lineB'),

});

this.addSignal('crossDown', crossDown);

}

next(ctx) {

const { index, signals } = ctx;

if (index < this.params.n1 || index < this.params.n2) return;

if (signals.get('crossUp')) this.buy({ size: 1000 });

if (signals.get('crossDown')) this.sell({ size: 1000 });

}

}After preparing historical data and implementing the trading strategy, you can run the backtest. Calling the Backtest.run() method will execute the backtest and return a Stats instance, which includes the simulation results of our strategy and related statistical data.

const backtest = new Backtest(data, SmaCross, {

cash: 1000000,

tradeOnClose: true,

});

backtest.run() // run the backtest

.then(results => {

results.print(); // print the results

results.plot(); // plot the equity curve

});In the above strategy, we provide two variable parameters params.n1 and params.n2, which represent the period of two moving averages. We can optimize the parameters and find the best combination of multiple parameters by calling the Backtest.optimize() method. Setting the params option in this method can change the parameter settings provided by the Strategy, and Backtest.optimize() will return the best combination of parameters provided.

backtest.optimize({

params: {

n1: [5, 10, 20],

n2: [60, 120, 240],

},

})

.then(results => {

results.print(); // print out the results of the optimized parameters

results.plot(); // plot the equity curve of the optimized parameters

});See /doc/fugle-backtest.md for Node.js-like documentation of @fugle/backtest classes.